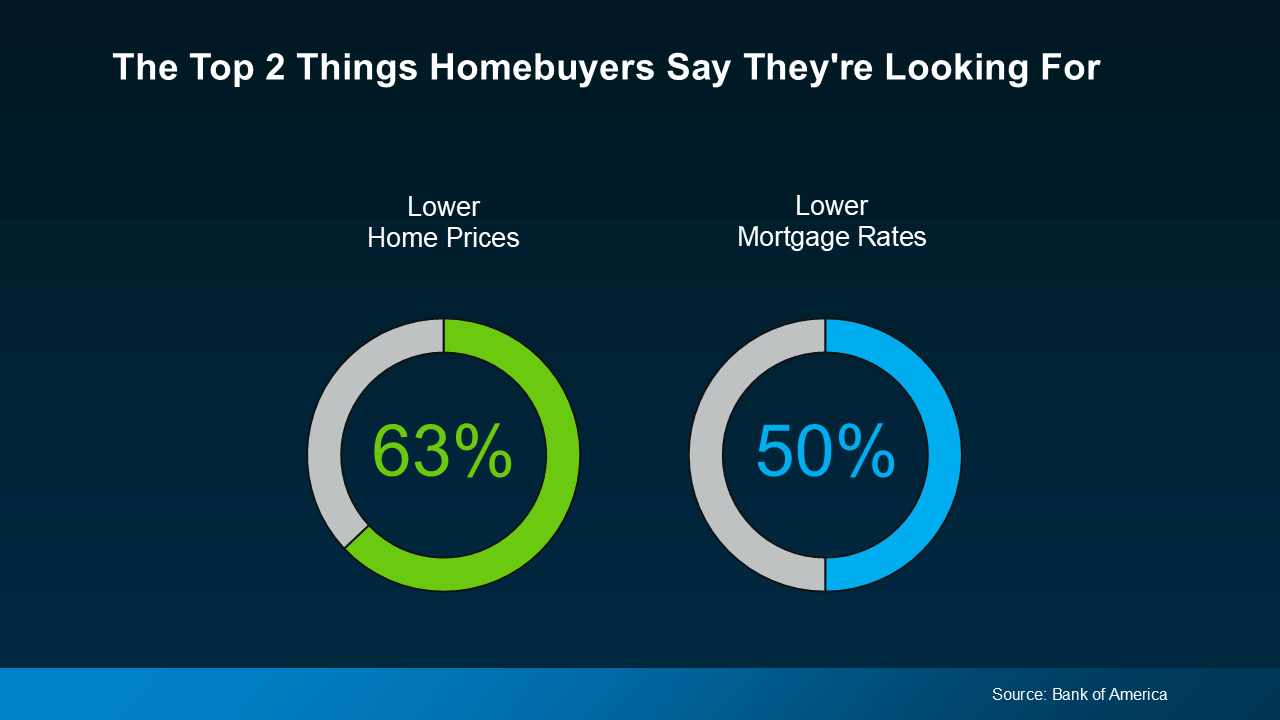

A recent survey from Bank of America asked would-be homebuyers what would help them feel better about making a move, and it’s no surprise the answers have a clear theme. They want affordability to improve, specifically prices and rates (see below):

Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.

Here’s the good news. While the broader economy may still feel uncertain, there are signs the housing market is showing some changes in both of those areas. Let’s break it down so you know what you’re working with.

Prices Are Moderating

Over the past few years, home prices climbed fast, sometimes so fast it left many buyers feeling shut out. But today, that pace has slowed down. For comparison, from 2020 to 2021, prices rose by 20% in a 12-month period. Now? Nationally, experts are projecting single-digit increases this year – a much more normal pace.

That's a sharp contrast to the rapid growth we saw just a few short years ago. Just remember, price trends are going to vary by area. In some markets, prices will continue to rise while others will experience slight declines.

Prices aren’t crashing, but they are moderating. For buyers, the slowdown makes buying a home a bit less intimidating. It’s easier to plan your budget when home values are moving at a much slower pace.

Mortgage Rates Are Easing

At the same time, rates have come down from their recent highs. And that’s taken some pressure off would-be homebuyers. As Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Even a small drop in mortgage rates can mean a big difference in what you pay each month in your future mortgage payment. Just remember, while rates have come down a bit lately, they’re going to experience some volatility. So don’t get too caught up in the ups and downs.

The overall trend in the year ahead is that rates are expected to stay in the low to mid-6s – which is a lot better than where they were just a few short months ago. They may even drop further, depending on where the economy goes from here.

Why This Matters

Confidence in the economy may be low, but the housing market is showing signs of adjustment. Prices are moderating, and rates have come down from their highs.

For you, that may not solve affordability challenges altogether, but it does mean conditions look a little different than they did earlier this year. And those shifts could help you re-engage as we move into next year.

Bottom Line

Both of the top concerns for buyers are seeing some movement. Prices are moderating. Rates are easing. And both trends could stick around going into 2026.

If you’re considering a move, connect with a local real estate agent to walk you through what’s happening in your area – and what it means for your plans.

]]> For Buyers Home Prices First-Time Buyers Mortgage Rates Affordability Wed, 01 Oct 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/29/closing-costs-unpacked-state-by-state-breakdowns-for-todays-buyers?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

If you’re planning to buy a home this year, there’s one expense you can’t afford to overlook: closing costs.

]]>

If you’re planning to buy a home this year, there’s one expense you can’t afford to overlook: closing costs.

Almost every buyer knows they exist, but not that many know exactly what they cover, or how different they can be based on where you're buying. So, let’s break them down.

What Are Closing Costs?

Your closing costs are the additional fees and payments you make when finalizing your home purchase. Every buyer has them. According to Freddie Mac, they typically include things like homeowner insurance and title insurance, as well as various fees for your:

- Loan application

- Credit report

- Loan origination

- Home appraisal

- Home inspection

- Property survey

- Attorney

National vs. Local: Why the Numbers Look So Different

When you search for information about closing costs online, you’ll often see a national range, usually 2% to 5% of the home’s purchase price. While that’s a useful starting point if you’re working on your homebuying budget, it doesn’t tell the whole story. In reality, your closing costs will also vary based on:

- Taxes and fees where you live (like transfer taxes and recording fees)

- Service costs for things like title and attorney work in your local area

While the home price is obviously going to matter, state laws, tax rates, and even the going costs for title and attorney services can change what you expect to pay. That’s why it's important to talk to the pros ahead of time so you know what to budget for. It can put you in control before you even start shopping.

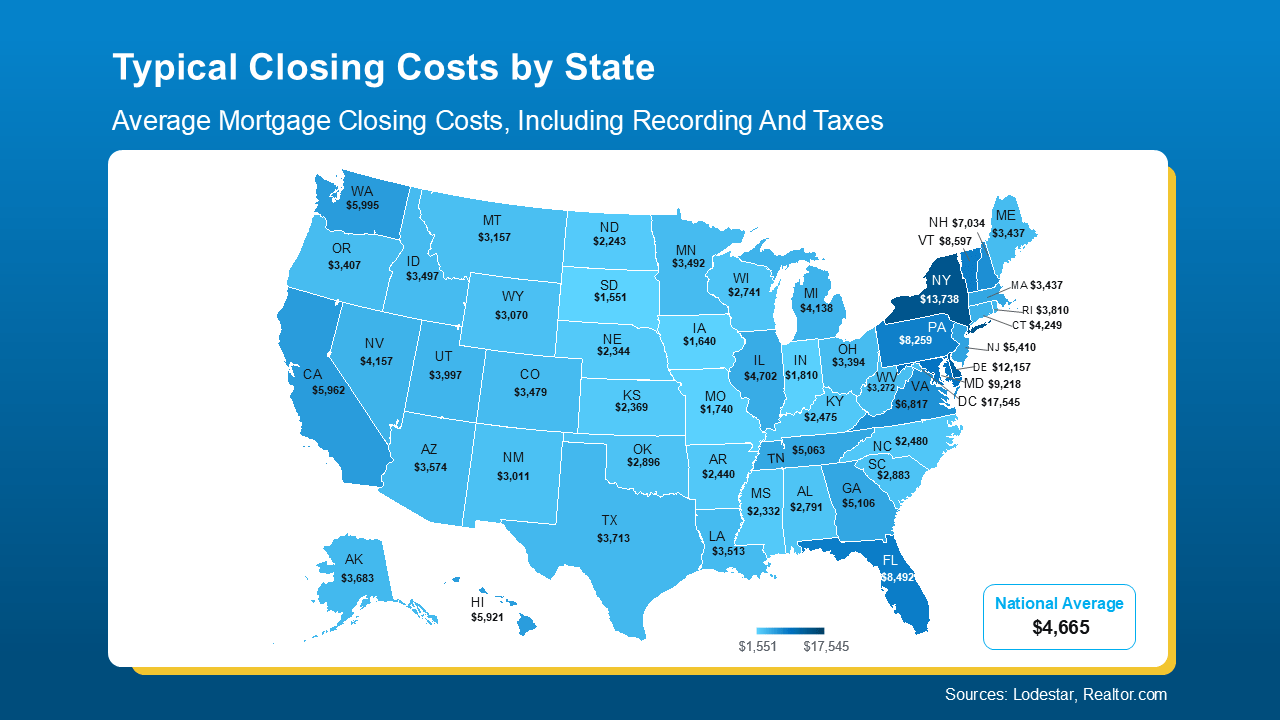

To give you a rough ballpark, here’s a state-by-state look at typical closing costs right now based on those factors for the median-priced home in each state (see map below):

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

If you want a real number to help with your budget, your best bet is to talk to a local agent and a lender. They can run the math for your price range, loan type, and exact location.

And just in case you’re looking at your state’s number and wondering if there’s any way to trim that bill, NerdWallet shares a few strategies that can help:

- Negotiate with the seller. Ask for concessions like a credit toward your closing costs.

- Shop around for homeowner’s insurance. Compare coverage and rates before you commit.

- Check for assistance programs. Some states, professions, and neighborhoods offer help. Your agent and lender can point you to what’s available locally.

Bottom Line

Closing costs are a key part of buying a home, but they can vary more than most people realize. Knowing your numbers (and how to potentially bring them down) can go a long way and help you feel confident about your purchase.

Connect with a local agent or lender to take a look at typical closing costs in your area and get your personalized estimate, so you can craft your ideal budget.

]]> For Buyers First-Time Buyers Mon, 29 Sep 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/25/downsizing-without-debt-how-more-homeowners-are-buying-their-next-house-in-cash?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

If you’ve been thinking about downsizing to lower your expenses, be closer to family, or just make life easier, here's a trend worth paying attention to

]]>

If you’ve been thinking about downsizing to lower your expenses, be closer to family, or just make life easier, here's a trend worth paying attention to:

More homeowners are buying their next house outright, without taking on a new mortgage. And, if you’ve owned your home for a while, you may be able to do the same. No mortgage. No monthly housing payments.

A Record Share of Homeowners Are Mortgage-Free

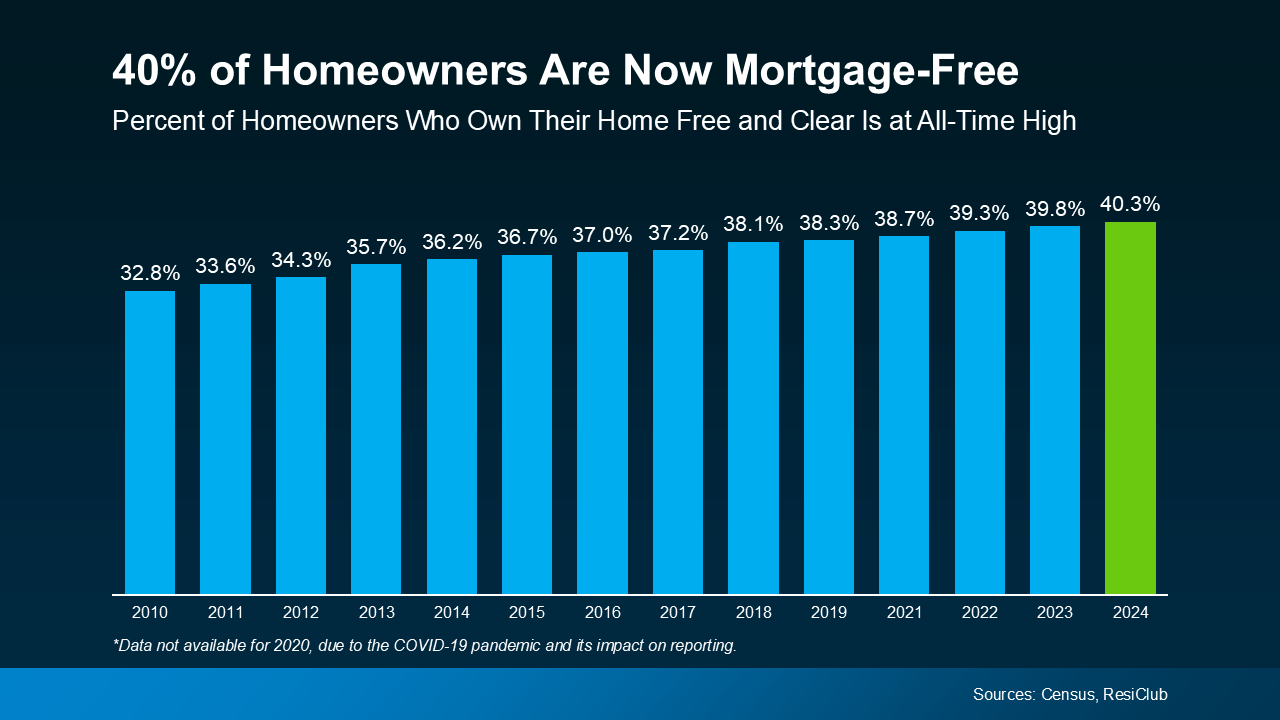

According to analysis from ResiClub of Census data, more than 40% of U.S. owner-occupied homes are mortgage-free – an all-time high for this data series. That means 4 in 10 homeowners own their homes free and clear (see graph below):

One big reason for this trend? Demographics. As Baby Boomers age and stay in their homes longer, many have had the time to fully pay off their mortgages. You might be in that group too and not even realize just how much buying power you now have. It’s time to change that.

One big reason for this trend? Demographics. As Baby Boomers age and stay in their homes longer, many have had the time to fully pay off their mortgages. You might be in that group too and not even realize just how much buying power you now have. It’s time to change that.

How Downsizers Are Turning Equity into Buying Power

As a homeowner, your equity is your biggest advantage in today’s market. If you’re mortgage-free (or close to it), it could give you the power to buy your next home in cash. That means you’d still have no mortgage payment in retirement, plus:

- Less financial stress as you age

- More cash flow, if you purchase a less expensive home

- And it would likely be a faster, simpler transaction

Here's how it works. You’d sell your current house and use the proceeds to buy your next house in cash. And while that may sound like something you thought would never be possible for you, it's more realistic than you may think.

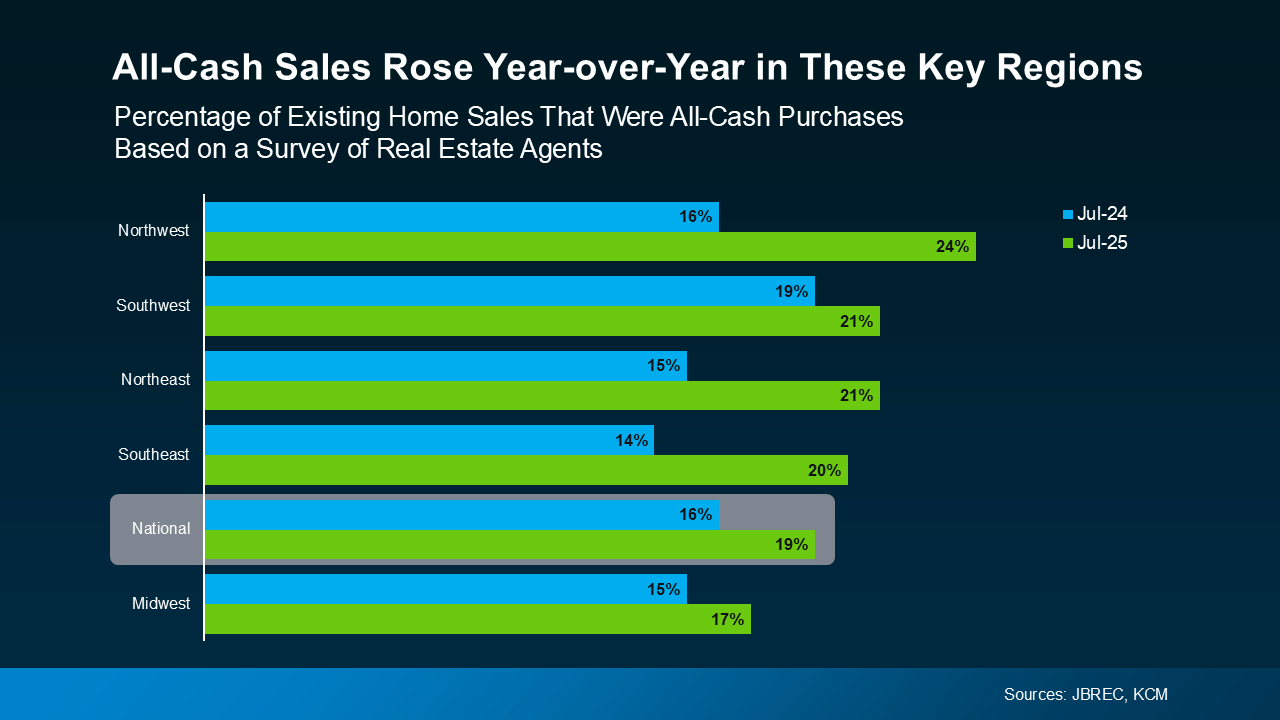

In the latest survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM), agents reported the share of purchases with all-cash buyers is climbing nationally. And those agents are seeing increases in almost every region of the country (see graph below):

For Baby Boomers especially, buying in cash gives you more control over your next chapter. You could buy a smaller, less expensive home and have lower costs, less upkeep, and more flexibility to enjoy what matters most. All while staying debt and stress free.

For Baby Boomers especially, buying in cash gives you more control over your next chapter. You could buy a smaller, less expensive home and have lower costs, less upkeep, and more flexibility to enjoy what matters most. All while staying debt and stress free.

Because downsizing isn't about downgrading your home. It’s about upgrading your quality of life. And that’s something worth exploring.

Bottom Line

You’ve worked hard for your house. Now it might be time for it to work hard for you.

Talk to your agent about what your house is worth, and what it could unlock for you today. What would your ideal home look like if you were to downsize right now?

]]> For Sellers Downsize Equity Selling Tips Thu, 25 Sep 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/24/why-buyers-and-sellers-face-very-different-conditions-today?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

There’s a new divide in housing right now. In some states, buyers are gaining ground. In others, sellers still have the upper hand. It all depends on where you live.

]]>

There’s a new divide in housing right now. In some states, buyers are gaining ground. In others, sellers still have the upper hand. It all depends on where you live. Curious what's happening in your state?

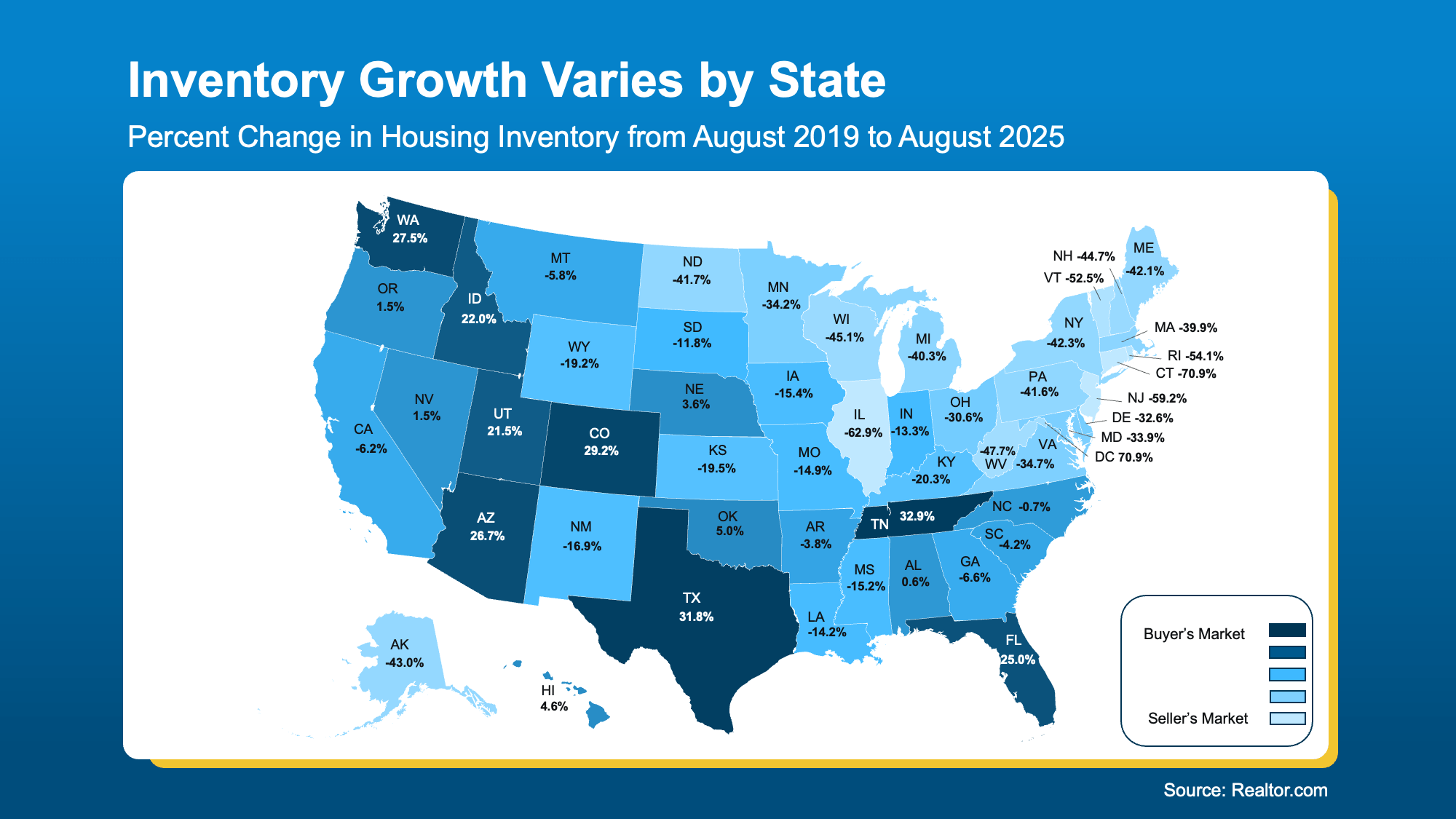

These 3 maps show how the split is playing out across the country. In each one:

- Darker Shades of Blue = Buyer friendly

- Lighter Shades of Blue = Seller strong

Inventory Sets the Stage

While the number of homes for sale has improved pretty much across the board, how much growth we’ve seen can look dramatically different based on where you live. And that impacts who has the leverage today.

This map uses data from Realtor.com to break it down:

- The darker shades of blue show where inventory has risen more than in other areas of the country. Buyers here have more to choose from and should have an easier time finding a home and leveraging their negotiating power.

- The lighter shades of blue are where inventory is still low. Sellers are more likely to sell quickly and make fewer concessions.

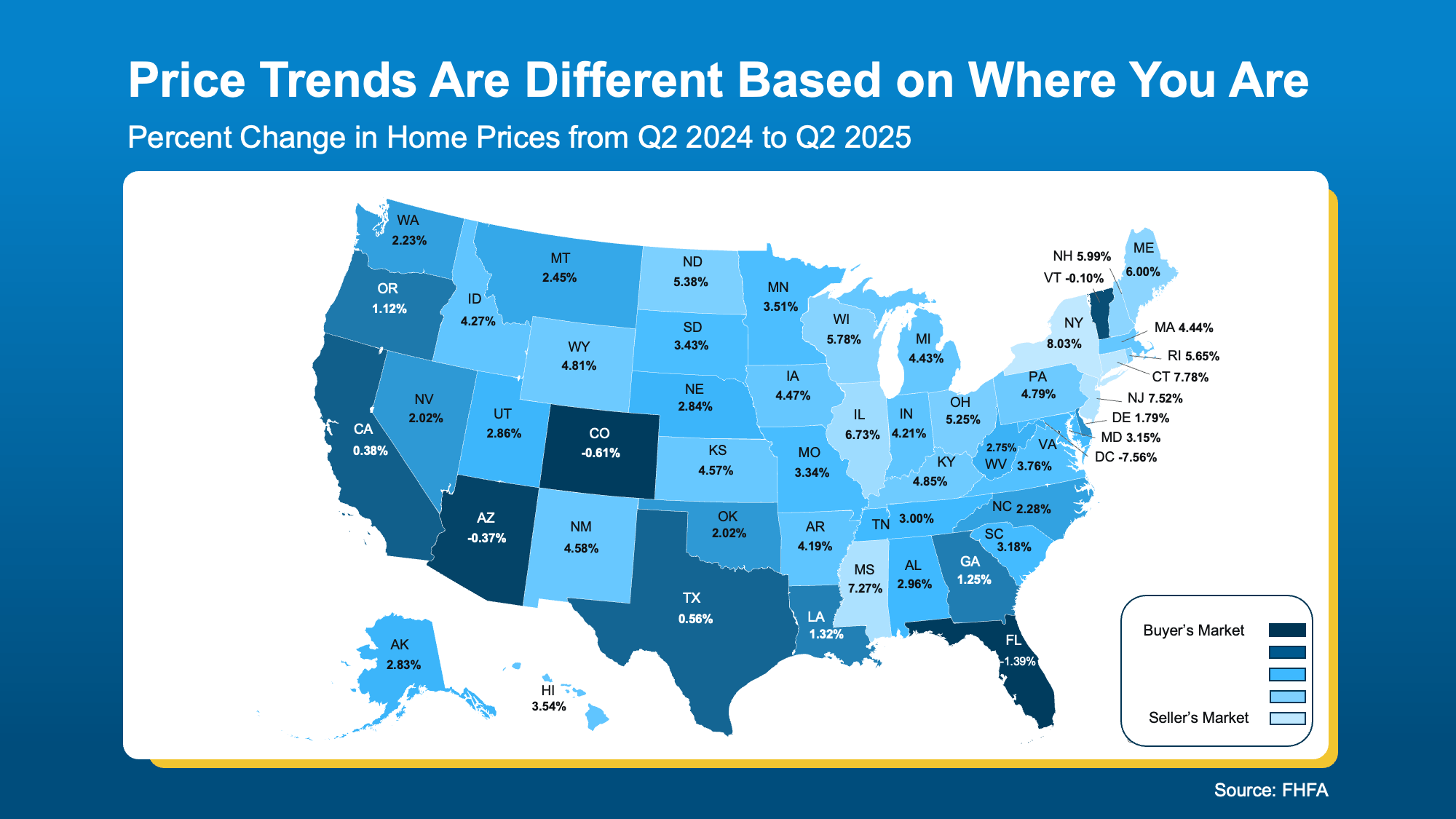

Prices Follow Inventory

Prices Follow Inventory

The second map tracks how home prices are shifting by state. Just like above, you can see the divide taking shape. Many of the same areas are darker blue. That’s because there’s such a close tie between inventory and prices. When inventory rises, prices moderate.

- The darker shades of blue are where prices are actually coming down slightly or flattening. Because, with more homes for sale, sellers may have to cut their price or throw in concessions to get a deal done. And that benefits budget-conscious buyers.

- The lighter shades of blue show areas where prices are still climbing because inventory is low. Sellers may still see buyers competing for homes, and that pushes prices higher.

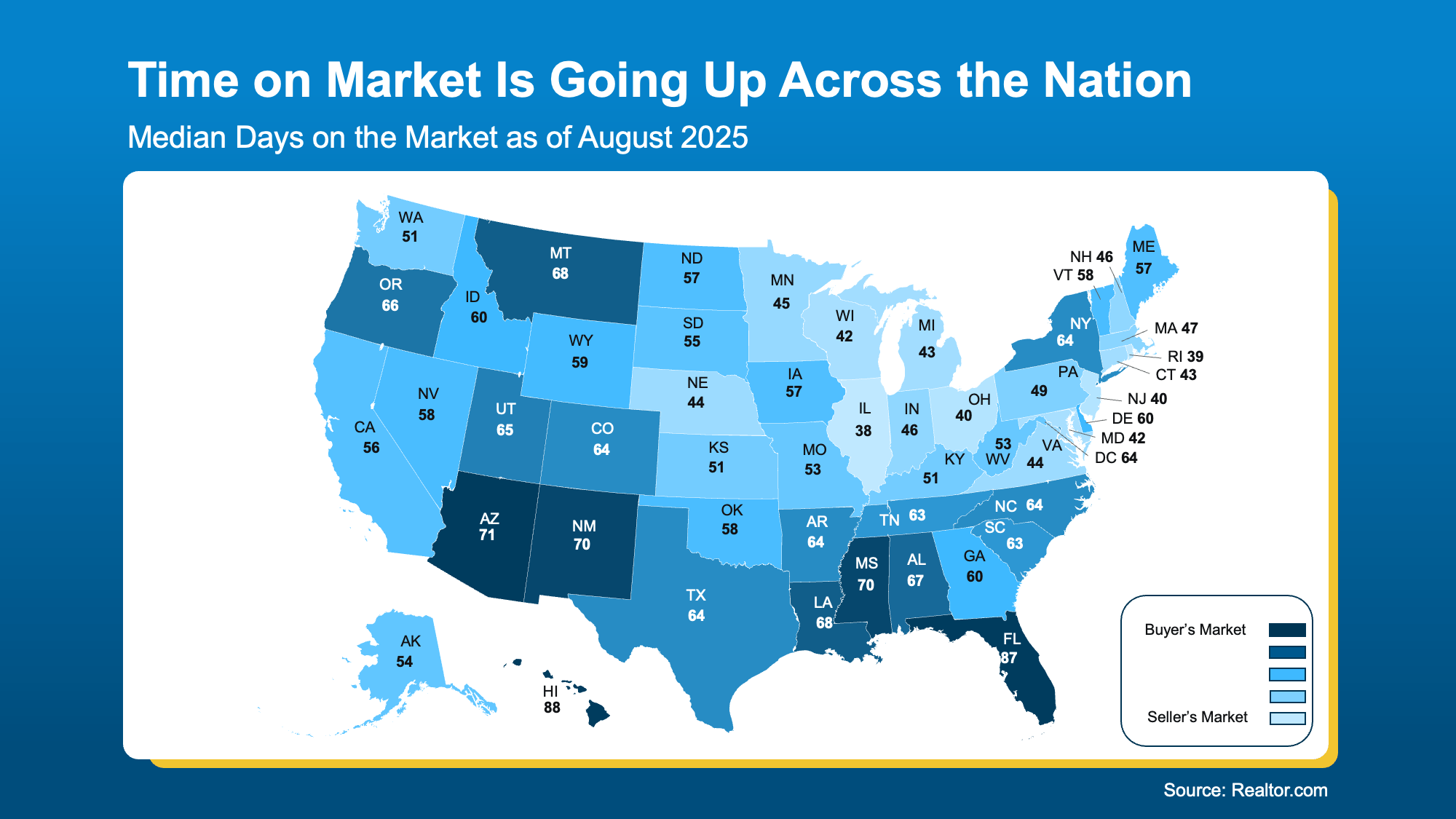

Time on Market Tells the Same Story

Time on Market Tells the Same Story

Finally, here’s how quickly homes are selling state by state. See the colors? For the most part, they follow the same general pattern with a lot of the darker blues being in the lower half of the country. And here’s why.

Generally speaking, as inventory grows, homes don’t sell as quickly. That’s why some of the same areas that have more inventory, see homes take more time to sell.

- The darker blues show where homes are staying on the market longer. That gives buyers more time and options, and signals sellers may need to adjust their expectations.

- The lighter blues are where homes are still moving quickly. Sellers there may feel more confident, and buyers may need to act fast.

This explains why some sellers in these darker blue states are feeling frustrated when their listings linger, while others in tighter markets (like the lighter blue states) are still seeing their homes sell quickly.

This explains why some sellers in these darker blue states are feeling frustrated when their listings linger, while others in tighter markets (like the lighter blue states) are still seeing their homes sell quickly.

Why an Agent’s Local Expertise Is the Key To Unlocking Today’s Market

Basically, the housing market is experiencing a divide. And conditions are going to vary a lot based on where you live, where you’re moving, and if you’re buying or selling. While the state-level information helps, what really matters is what’s happening in your town and your neighborhood. And only a local agent truly has the information you need.

Bottom Line

Want to know what conditions look like in your neighborhood?

If you want to understand which side of the market you’re on, connect with a local agent. They’ll walk you through the numbers and what they mean for your next move.

]]> For Buyers For Sellers Home Prices Inventory Wed, 24 Sep 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/22/3-reasons-affordability-is-showing-signs-of-improvement-this-fall?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

For the past couple of years, it’s been tough for a lot of homebuyers to make the numbers work.

]]>

For the past couple of years, it’s been tough for a lot of homebuyers to make the numbers work. Home prices shot up. Mortgage rates too. And a number of people hit pause because it just didn’t feel possible. Maybe you were one of them.

But there’s some encouraging news. If you’ve been waiting for a better time to jump back in, affordability may finally be showing signs of improvement this fall.

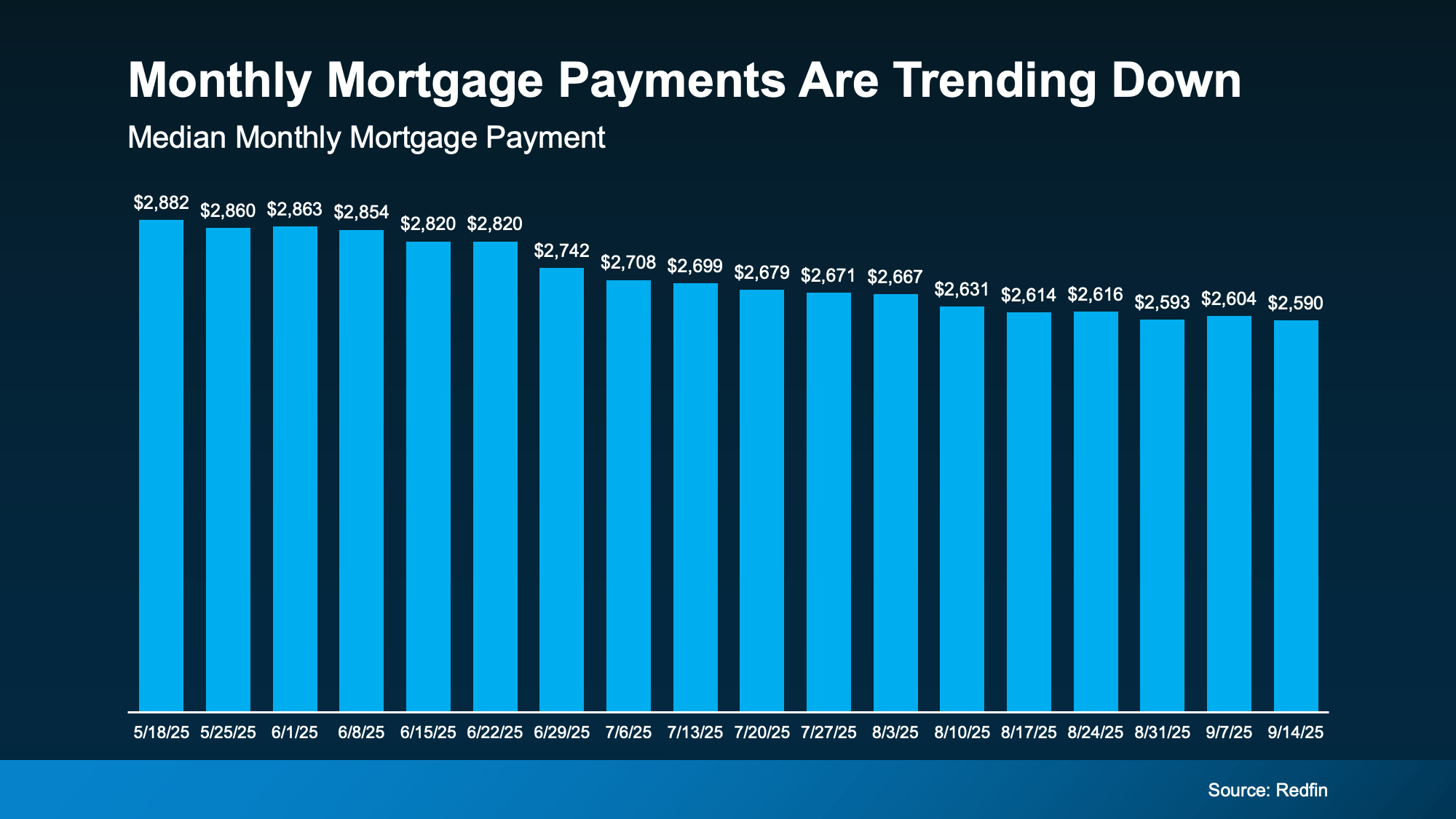

The latest data from Redfin shows the typical monthly mortgage payment has been coming down, and is now about $290 lower than it was just a few months ago (see graph below):

And here’s why this is happening. The cost of buying a home really comes down to three things:

And here’s why this is happening. The cost of buying a home really comes down to three things:

- Mortgage rates

- Home prices

- Your wages

Right now, all three are finally moving in a better direction for you. While that doesn’t mean it’s suddenly easy to buy at today’s rates and prices, it does mean it’s not as challenging.

1. Mortgage Rates

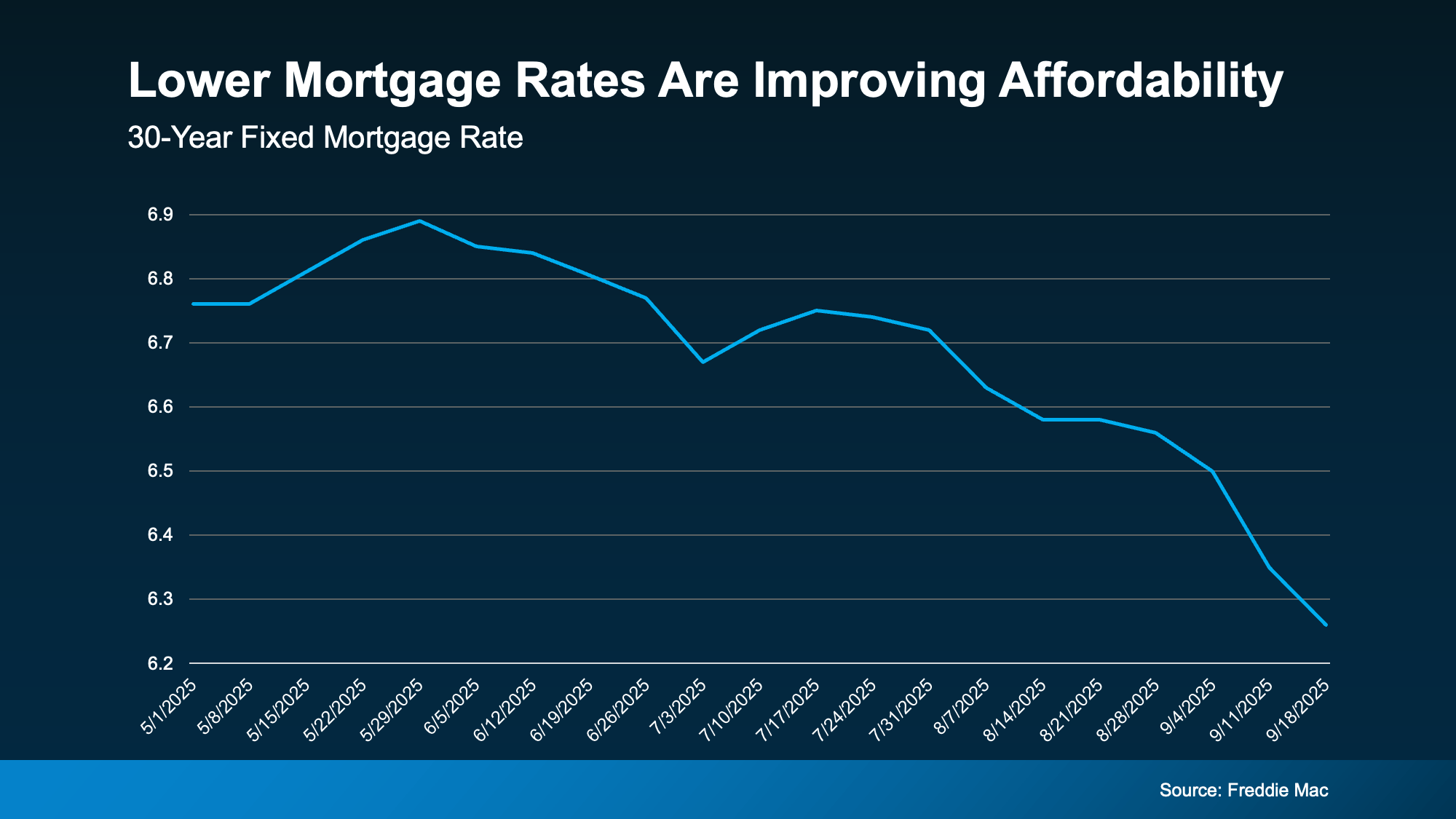

Mortgage rates have come down compared to earlier this year. In May, they were roughly 7%. And now, they’re closer to 6.3% (see graph below):

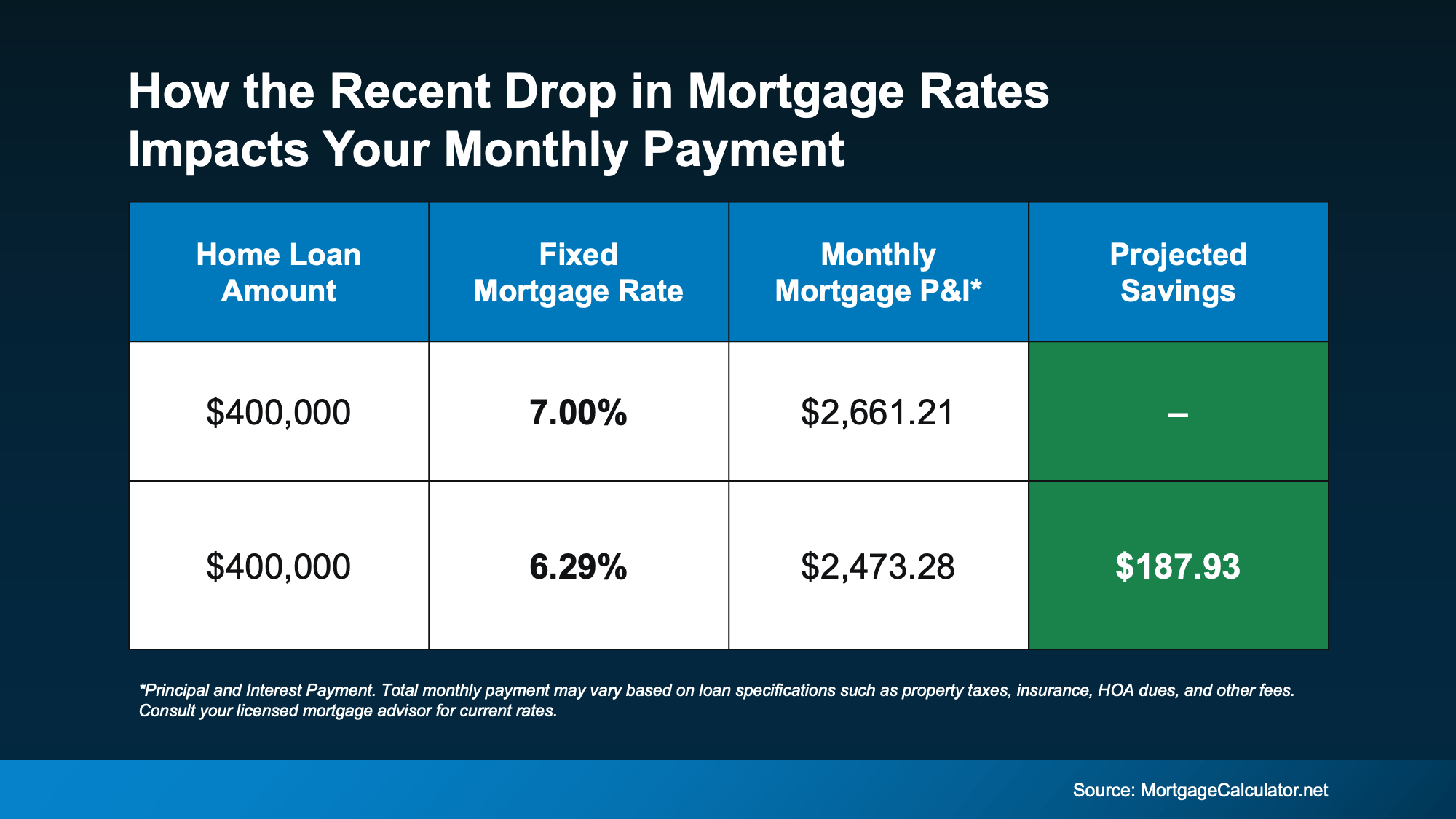

That may not sound like a big deal, but it does matter. Even small changes in rates can make a difference in your future monthly payment. Compared to when rates were 7%, if you take out an average $400K mortgage now at 6.3%, it’ll cost about $190 less a month based on just rates alone.

That may not sound like a big deal, but it does matter. Even small changes in rates can make a difference in your future monthly payment. Compared to when rates were 7%, if you take out an average $400K mortgage now at 6.3%, it’ll cost about $190 less a month based on just rates alone.

And for some people, that’s been enough to make buying a home possible again. As Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explained on September 10th:

“The downward rate movement spurred the strongest week of borrower demand since 2022 . . . Purchase applications increased to the highest level since July and continued to run more than 20 percent ahead of last year’s pace.”

2. Home Prices

After several years of prices rising very rapidly, price growth has finally slowed. As Odeta Kushi, Deputy Chief Economist at First American, puts it:

“National home price growth remains positive, but muted — low single digits — and we expect this trend to continue in the second half of the year.”

For buyers, that’s actually a big relief. That moderation makes it easier to plan your budget. And in some markets, prices have even dipped slightly. If you're in one of the markets, you may be able to find something that’s more affordable than you'd expect.

3. Wages

According to the Bureau of Labor Statistics (BLS), wages are up near 4% annually. Lawrence Yun, Chief Economist at NAR, explains why that number is so important right now:

“Wage growth is now comfortably outpacing home price growth, and buyers have more choices.”

In other words, the typical paycheck is rising faster than home prices right now, which helps make buying a little more affordable. Now, it’s not a big difference, but in a market like this, every bit counts.

What This Means for You

Lower rates, slower price growth, and stronger wages might be enough to make the numbers finally work for you this fall.

While affordability is still tight, it’s a little easier on your wallet to buy now than it was just few months ago. Remember, data from Redfin shows the typical monthly mortgage payment is already around $290 lower than it was earlier this year.

Bottom Line

Have you been wondering if it’s worth taking another look at buying?

Work with a professional to re-run the numbers. Together you can go over your budget, see what’s changed, and figure out if this fall is the time to turn window-shopping into key-turning.

]]> For Buyers Home Prices Mortgage Rates Affordability Buying Tips Mon, 22 Sep 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/18/do-you-know-how-much-your-house-is-really-worth?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

Want to know something important you probably don’t have a professional check for you nearly as often as you should? Spoiler alert: it’s the value of your home.

]]>

Want to know something important you probably don’t have a professional check for you nearly as often as you should? Spoiler alert: it’s the value of your home.

Because here’s the reality. Your house is likely the biggest financial asset you have. And if you’ve lived in it for a few years or more, chances are it’s been quietly building wealth for you in the background – even if you haven’t been keeping tabs on it.

You might be surprised by just how much it’s grown, even as the market has shifted over the past few months.

What Is Home Equity?

That hidden wealth in your home is called equity. It’s the difference between what your house is worth today and what you still owe on your mortgage. Your equity grows over time as home values rise and as you make your monthly payments. Here’s an example to help you really understand how the math works.

Let’s say your house is now worth $500,000, and you have $200,000 left to pay off on your loan. That means you have $300,000 in equity. And that’s right in line with what the typical homeowner has right now.

According to Cotality, the average homeowner with a mortgage has about $302,000 in equity.

Why You Probably Have More Than You Think

Here are the two main reasons homeowners like you have near record amounts of equity right now:

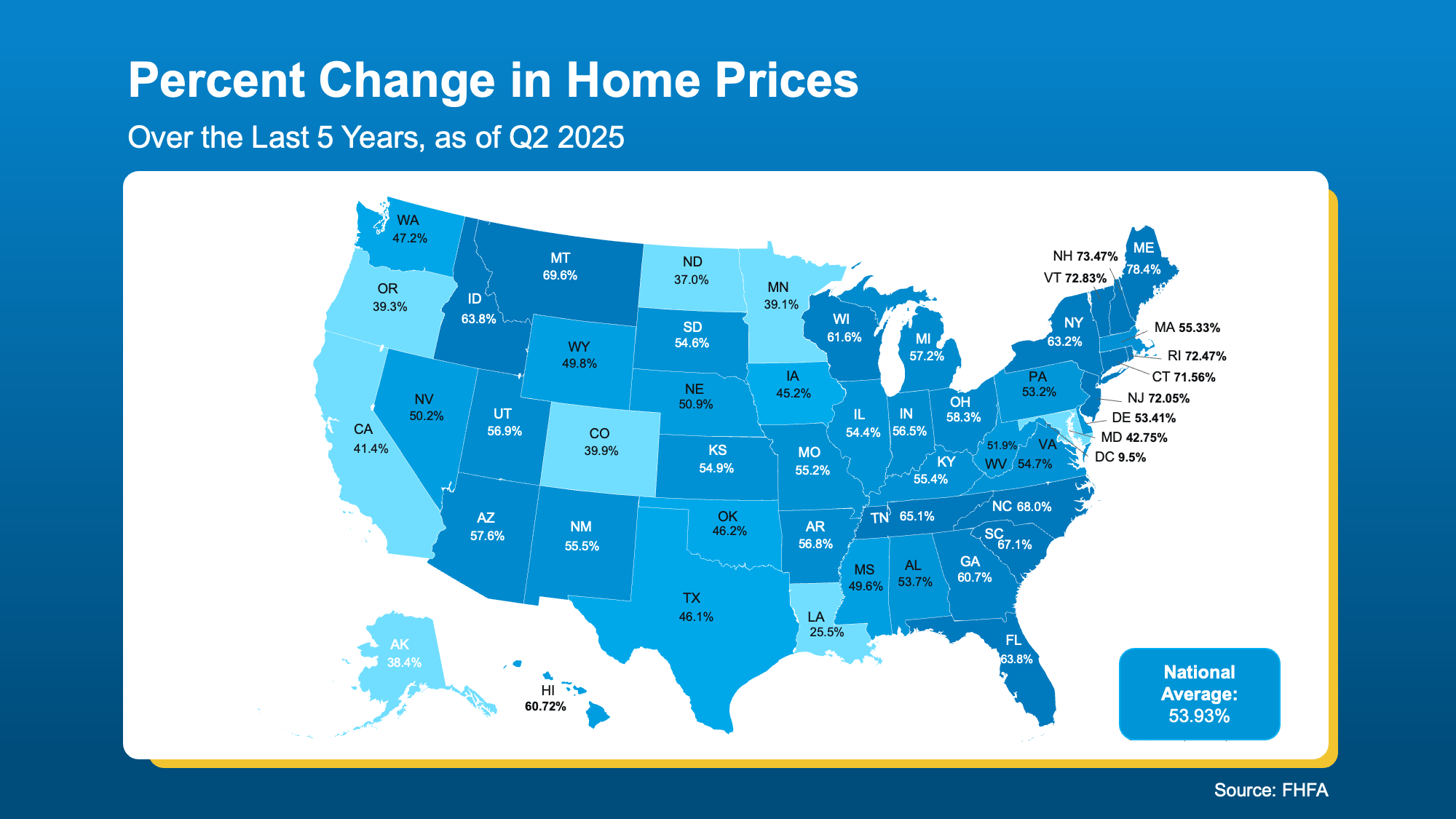

1. Significant Home Price Growth. According to the Federal Housing Finance Agency (FHFA), home prices have jumped by nearly 54% nationwide over the last five years (see map below):

This means your house is likely worth much more now than when you first bought it, thanks to how much prices have climbed over time. And if you’re worried because you’ve heard prices are flattening or even coming down in some markets, just know if you’ve been in your house for a few years (or more) you very likely have enough equity to sell and still come out ahead.

This means your house is likely worth much more now than when you first bought it, thanks to how much prices have climbed over time. And if you’re worried because you’ve heard prices are flattening or even coming down in some markets, just know if you’ve been in your house for a few years (or more) you very likely have enough equity to sell and still come out ahead.

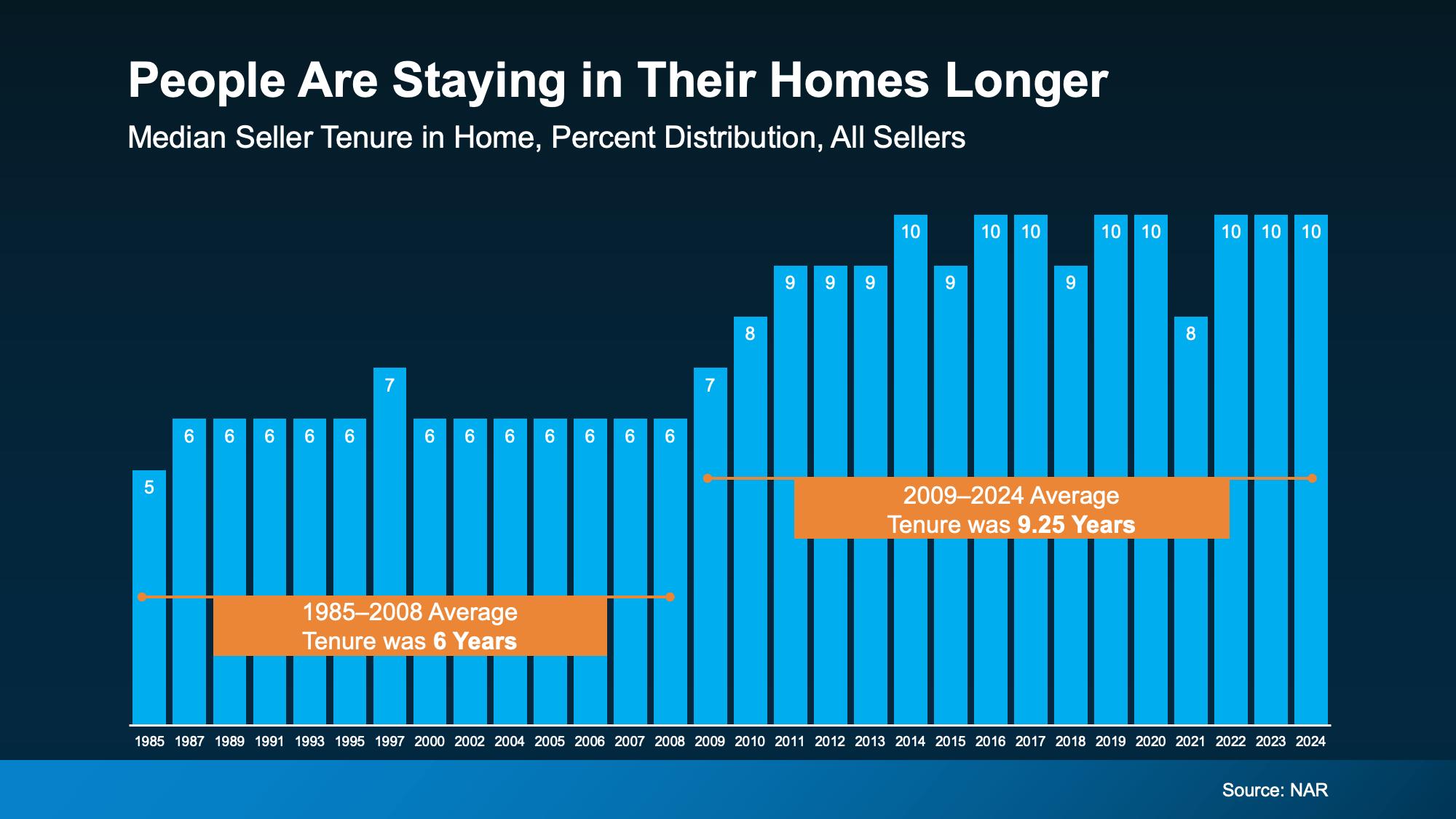

2. People Are Living in Their Homes Longer. Data from the National Association of Realtors (NAR), shows the average homeowner stays in their home for about 10 years now (see graph below):

That’s longer than it used to be. And over that decade? You’ve built equity just by making your mortgage payments and riding the wave of rising home values. Because the financial side of homeownership is about playing the long game, not worrying about little ups and downs in the market here and there. And over time, that means you’re winning.

That’s longer than it used to be. And over that decade? You’ve built equity just by making your mortgage payments and riding the wave of rising home values. Because the financial side of homeownership is about playing the long game, not worrying about little ups and downs in the market here and there. And over time, that means you’re winning.

So, if you’re one of those people who’s been in their home for a bit, here’s how much the behind-the-scenes price growth has helped you out. According to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

What Could You Actually Do with That Equity?

Your equity isn’t just a number. It’s a tool you can use to unlock your next big move. Depending on your goals, you could:

- Use it to help buy your next home. Your equity could help you cover the down payment on your next home. In some cases, it might even mean you can buy your next house in all cash.

- Renovate your current house to better suit your life now. And, if you’re strategic about your projects, they could add even more value to your home if you do sell later on.

- Start the business you’ve always dreamed of. Your equity could be exactly what you need for startup costs, equipment, software, or marketing. And that could help increase your earning potential, so you’re getting yet another financial boost.

Bottom Line

Chances are, your house is worth quite a bit right now. If you’re curious about the value of your home, connect with a local agent to run the numbers. That way, you’ll know what you’re working with and where you can go from here.

]]> For Sellers Equity Selling Tips Thu, 18 Sep 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/17/why-now-may-be-a-key-2025-moment-to-sell-your-house?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

Mortgage rates are finally heading in the right direction – and buyers are starting to jump back in.

]]>

Mortgage rates are finally heading in the right direction – and buyers are starting to jump back in.

According to the data, buyer demand picked up considerably once mortgage rates hit a new low for 2025. The Mortgage Bankers Association (MBA) reports that applications for home loans were up 23% compared to the first week of September last year.

If you’ve been waiting to sell, or your listing recently expired because the market was slower than you hoped it would be, now’s the time to reconsider your move. Buyer demand is the highest it’s been since July – and you don’t want to miss this window.

When Rates Drop, Buyers React

Here’s what’s happening. The 30-year mortgage rate dropped to 6.13% earlier this week. And that’s the lowest it had been since October 2024. That decline followed weak job growth and other economic indicators that are fueling speculation the Federal Reserve may cut the Federal Funds Rate multiple times this year. Mortgage rates started dropping because financial markets are anticipating those Fed decisions. And that opens the door for more buyers to act.

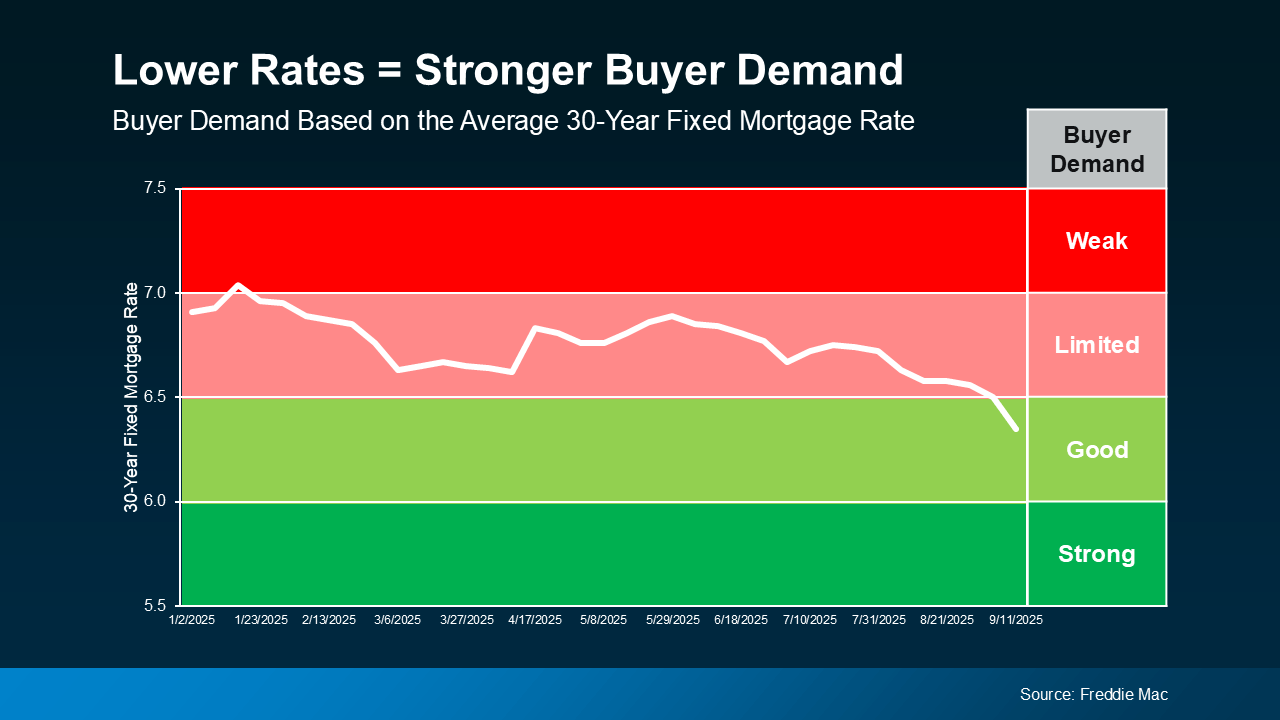

Since today’s buyers are looking at every angle to make home purchases more affordable, they’re much more sensitive to even the slightest movement in mortgage rates. Basically, it boils down to this. As affordability improves, so does buyer demand (see graph below):

And that’s a change you’re going to feel – in a good way. Since about this time last year, we’ve been in a plateau of “limited” buyer demand. But now that rates are coming down, buyer demand is getting better.

And that’s a change you’re going to feel – in a good way. Since about this time last year, we’ve been in a plateau of “limited” buyer demand. But now that rates are coming down, buyer demand is getting better.

What This Means for You

If you’re looking to move, it’s time to get serious about what’s happening in the market, and how you can use these key moments to your advantage. Maybe you have an expired listing that sat without offers earlier this year, or you held off on selling altogether, thinking buyers weren’t out there. This is your signal – they’re coming back. Now, it’s not in the big surge the market saw a few years ago, but this could be your window.

Here’s the opportunity. You can list, while buyer activity is rising and before more sellers in your neighborhood do too. Other homeowners may not see this shift for a while, so you can get a leg up on your competition if you act now.

On the flip side, if you wait, sure there may be more buyers if rates continue to inch down. But there are also going to be more sellers too. So, why take that risk?

A trusted local agent can help you assess your home’s value, fine-tune your pricing strategy, and make sure it stands out to the serious buyers who are taking action today.

Bottom Line

Buyers are watching rates, weighing their options, and starting to get off the sidelines. If you’re thinking about selling, this may be your chance to get ahead.

Want to make sure your house shows up for the right buyers, at the right time?

Connect with an agent to walk through the steps together so you can make the most of this moment.

]]> For Sellers Mortgage Rates Selling Tips Wed, 17 Sep 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/15/what-a-fed-rate-cut-could-mean-for-mortgage-rates?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But does that mean mortgage rates will drop?

]]>

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But does that mean mortgage rates will drop? Let’s clear up the confusion.

The Fed Doesn’t Directly Set Mortgage Rates

Right now, all eyes are on the Fed. Most economists expect they'll cut the Federal Funds Rate at their mid-September meeting to try to head off a potential recession.

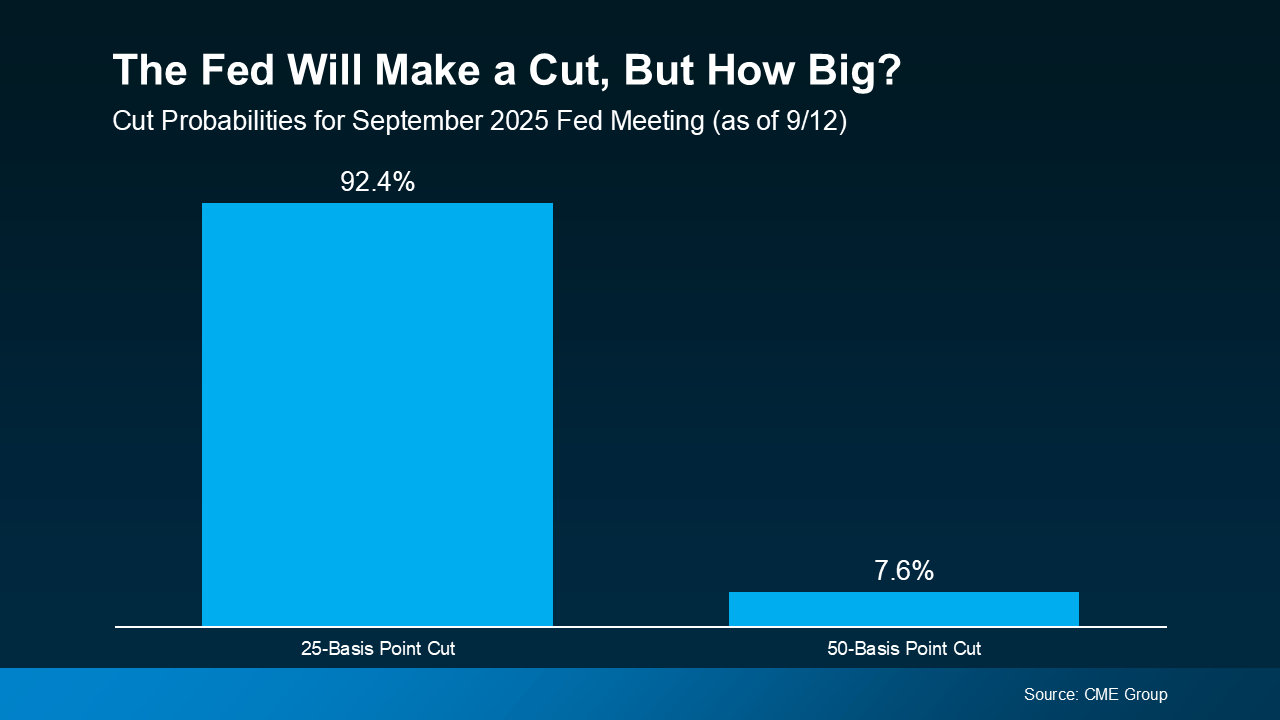

According to the CME FedWatch Tool, markets are already betting on it. There’s virtually a 100% chance of a September cut. And based on what we know now, there’s about a 92% chance it’ll be a small cut (25 basis points) and an 8% chance it will be a bigger cut (50 basis points):

So, what exactly is the Federal Funds Rate? It’s the short-term interest rate banks charge each other. It impacts borrowing costs across the economy, but it’s not the same thing as mortgage rates. Still, the Fed’s actions can shape the direction mortgage rates take next.

So, what exactly is the Federal Funds Rate? It’s the short-term interest rate banks charge each other. It impacts borrowing costs across the economy, but it’s not the same thing as mortgage rates. Still, the Fed’s actions can shape the direction mortgage rates take next.

Why Markets Already Saw This Cut Coming

Here’s the part that may surprise you. Mortgage rates tend to respond to what the financial markets think the Fed will do, before the Fed officially acts. Basically, when markets anticipate a Fed cut, that outlook gets priced into mortgage rates ahead of time.

That’s exactly what happened after weaker-than-expected jobs reports on August 1 and September 5. Each time, mortgage rates ticked down as financial markets grew more confident a cut was coming soon. And even though inflation rose slightly in the latest CPI report, the Fed is still expected to make a cut.

So, if the Fed goes with a 25-basis point cut, as expected, that’s likely already baked in to current mortgage rates, and we may not see a dramatic drop.

But if they go bigger and drop their Federal Funds Rate by 50 basis points instead, mortgage rates could come down more than they already have.

So, Where Do Mortgage Rates Go from Here?

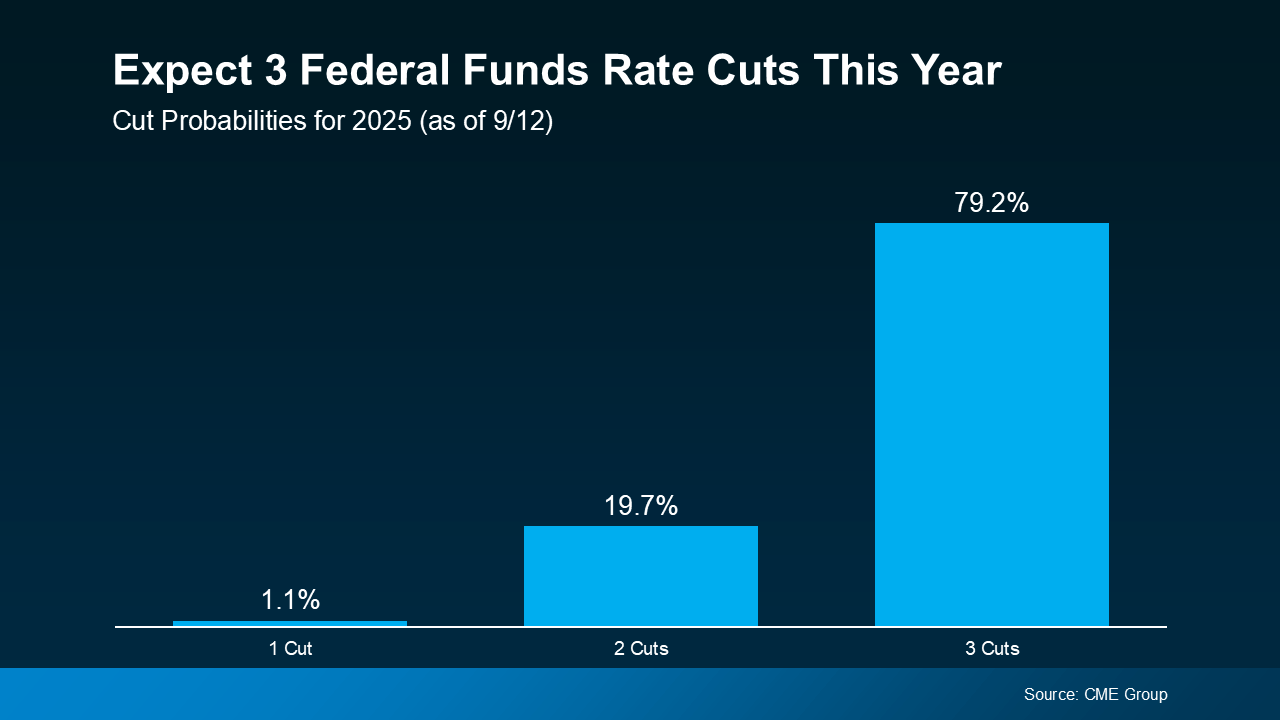

While the upcoming cut may not move the needle much, many experts expect the Fed could cut the Federal Funds Rate more than once before the end of the year. Of course, that’s if the economy continues to cool (see graph below):

As Sam Williamson, Senior Economist at First American, explains:

As Sam Williamson, Senior Economist at First American, explains:

“For mortgage rates, investor confidence in a forthcoming rate-cutting cycle could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability and potentially helping to boost buyer demand and overall market activity.”

If multiple rate cuts happen, or even if markets just believe they will, mortgage rates could ease further in the months ahead. But here’s the catch – all of this depends on how the economy evolves. Surprise inflation data or unexpected shifts could quickly change the outlook.

Bottom Line

Mortgage rates likely won’t drop sharply overnight, and they won’t mirror the Fed’s moves one-for-one. But if the Fed begins a rate-cutting cycle, and markets continue to expect it, mortgage rates could trend lower later this year and into 2026.

If you’ve been waiting and watching the housing market, now’s the time to talk strategy. Even small changes in rates can make a meaningful difference in affordability, and understanding what’s ahead helps you make the best decision for your situation.

]]> For Buyers Mortgage Rates Affordability Economy Mon, 15 Sep 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/11/patience-wont-sell-your-house-pricing-will?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

Waiting for the perfect buyer to fall in love with your house? In today’s market, that’s usually not what’s holding things up. And here’s why.

]]>

Waiting for the perfect buyer to fall in love with your house? In today’s market, that’s usually not what’s holding things up. And here’s why.

Let’s be real. Homes are taking a week longer to sell than they did a year ago. According to Realtor.com:

“Homes are also taking longer to sell. The typical home spent 60 days on the market in August, seven days longer than last year and now above pre-pandemic norms for the second consecutive month. This was the 17th straight month of year-over-year increases in time on market.”

Part of that is because there are more homes on the market. So, with more options for buyers to choose from, they aren’t getting snatched up quite as fast. But there’s another big reason: price.

The Average List Price Isn’t Going Up – and That Matters

Today, a lot of homeowners are overshooting their list price. They remember the big climb in home prices a few years ago, and they don’t realize how much has changed.

One of the most important, but often overlooked, changes in today’s housing market is this: average list prices have held steady for the past few years.

That’s a big shift from a typical market, where prices were rising steadily each year. And it’s significantly different than the 2021-2022 surge when sellers could set their price just about anywhere and still attract multiple offers over asking.

But now? That trend has leveled off – and sellers who want to stay competitive need to take note (see graph below):

Here’s what this says about today’s market. Buyers are a lot more price sensitive now. And sellers can’t keep trying to inch the bar higher, or their house will sit without any offers.

Here’s what this says about today’s market. Buyers are a lot more price sensitive now. And sellers can’t keep trying to inch the bar higher, or their house will sit without any offers.

Homeowners who expect to bring in more than their neighbors did last year may be setting themselves up for a longer, more frustrating experience.

And while homeowners are starting to realize prices can’t keep climbing at such a rapid pace, the hiccup is that list prices aren’t actually coming down yet as a result. They’re hanging around, holding steady. And sellers who make this mistake are often holding onto hope that they’ll be able to eek a few more dollars out of their sale. But that’s the problem right there.

If you want to sell today, you need to be in line with where the market is today. Not last year. Not during the pandemic. Today.

Because buyers will skip over homes that feel overpriced, even if it’s only by a little. It’s not that they aren’t interested. It’s just that in a market with more homes to choose from, buyers can be more selective, and sellers don’t get the same benefit of the doubt. If your house isn’t priced to sell, buyers just move on. They’ve got other options anyway.

4 Signs Your Price May Be Too High

You may already be feeling this yourself. If your home is listed and you’re not seeing results, watch for these common red flags noted by Bankrate:

- You’re not getting many showings

- You haven’t gotten any offers (or you’ve only gotten lowball offers)

- Buyers that do come to see your house leave overly negative feedback

- Your house has been sitting on the market longer than the average for your area

If any of these sound familiar, know that waiting it out won’t fix it. But adjusting your price will.

So, What’s the Solution?

Work with your agent to make sure your house is positioned for today’s market. Depending on your what’s happening in your local area, a few weeks without traction can raise questions for buyers about whether your price is realistic. And don’t worry – it doesn’t have to be a big drop. Even a small adjustment can be enough to bring the right buyers through the door.

And if you’re worried you won’t get the high-ticket sale price you thought you would be able to land, keep in mind that your equity has probably grown quite a bit. Chances are, you’re still ahead of the game simply because you invested in a home over the last 5, 10, or more years. You’re still winning when you sell today.

Bottom Line

Patience isn’t a strategy. Pricing is.

If your home isn’t moving, the market is telling you something – and the right price can change everything. Your house will sell, if you price it strategically.

Talk to your agent about what buyers are willing to pay right now to make sure your home stands out for all the right reasons.

]]> For Sellers Home Prices Selling Tips Thu, 11 Sep 2025 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2025/09/10/mortgage-rates-just-saw-their-biggest-drop-in-a-year?a=530532-1bca0d4cd8b9ef262417a67af2aa0076

You’ve been waiting for what feels like forever for mortgage rates to finally budge. And last week, they did – in a big way.

]]>

You’ve been waiting for what feels like forever for mortgage rates to finally budge. And last week, they did – in a big way.

On Friday, September 5th, the average 30-year fixed mortgage rate fell to the lowest level since October 2024. It was the biggest one-day decline in over a year.

What Sparked the Drop?

According to Mortgage News Daily, this was a reaction to the August jobs report, which came out weaker-than-expected for a second month in a row. That sent signals across the financial markets, and then mortgage rates came down as a result.

Basically, we're seeing signs the economy may be slowing down, and as certainty grows in the direction the economy is going, the markets are reacting to what is likely ahead. That historically brings mortgage rates down.

Why Buyers Should Pay Attention Now

But this isn’t just about one day of headlines or one report. It’s about what the drop means for you.

This recent change saves you money when you buy a home. The chart below shows you an example of what a monthly mortgage payment (principal and interest) would be at 7% (where mortgage rates were in May) versus where rates roughly are now:

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

How Long Will It Last?

That really depends on where the economy and inflation go from here. Rates could drop lower, or they could inch up slightly.

So, make sure you’re connected with a good agent and trusted lender. They’ll keep a close eye on inflation indicators, job market updates, and reactions to upcoming Fed policy to gauge where mortgage rates may go from here.

But for now, focus on this. While no one can say for sure where rates are headed, the fact that rates broke out of their months-long rut is a good thing. If you’ve been feeling stuck, this could make the start of a new chapter. As Diana Olick, Senior Real Estate and Climate Correspondent at CNBC, says:

“Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.”

And that’s gives you more reason to hope than you've had in quite some time.

Bottom Line

This is the shift you’ve been waiting for.

Mortgage rates just saw their biggest decline in over a year. And if rates stay near this level, it could make a home you couldn’t afford just a few months ago feel possible again.

What would today’s rates save you on your future monthly payment? Connect with an agent or lender so you can find out.

]]> For Buyers First-Time Buyers Mortgage Rates Affordability Economy Wed, 10 Sep 2025 10:30:00 +0000